For Broker's

We will help you find the right market that is ready and willing to assist with your client’s insurance needs.

For Broker's

We will help you find the right market that is ready and willing to assist with your client’s insurance needs.

Current Practices

In the insurance market, reliance on who you know is key. The market trades off the networking ability of both brokers and underwriters, with many conversations about the ‘who, what and where’ being conducted outside of the office. As a broker, how can you guarantee you know all the markets that can write your risks? How can you be sure you’re treating the customer fairly? How do you source the necessary capacity when all your existing markets have been approached? Beyond speaking to the network of underwriters in place, scouring the internet or begging for a favour, there is no current source to find the right underwriter with a risk appetite that befits your risks.

This is where we can help you.

Save time. Stay ahead.

By offering transparency and reach across the market, we have created a tool that will save brokers time, allowing them to stay ahead in an increasingly competitive global insurance market.

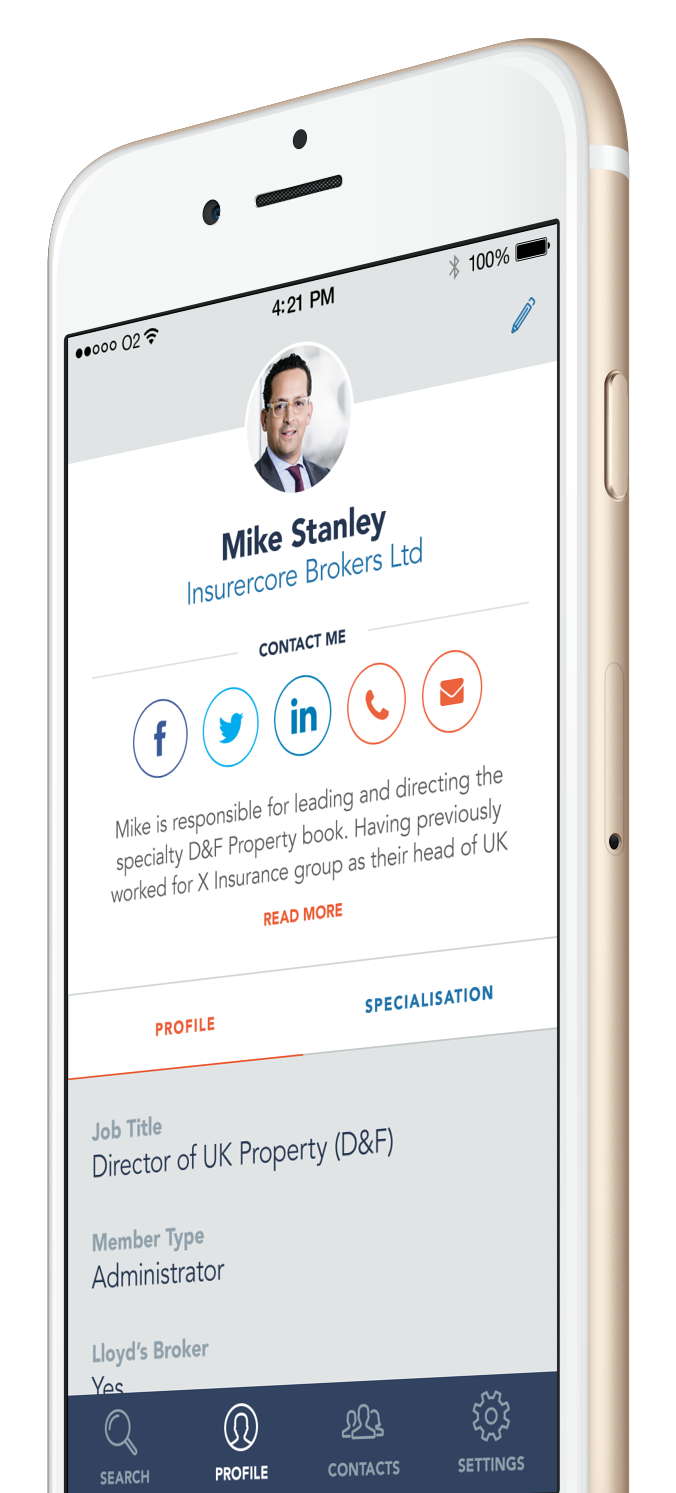

With our software, you can easily create a company marketing page including your logo, general marketing points and employee names and job roles.

How Insurercore

can help

By providing new age technology to help Brokers identify business opportunities we can increase the speed at which you handle your business and increase your reach.

We provide a quick and easy way to stay in contact with your current network ensuring that no time is wasted tracking risk appetite changes of insurers or job moves within the market.

We can help you expand your network by providing you with relevant risk appetites, allowing you to provide a more competitive offer for you client as well as increase your ability to place risker faster.

Always stay updated

By knowing your underwriters’ most up-to-date risk appetite and receiving notifications of when these change, we can reduce your chances of having risks declined thereby saving you wasted time and effort.

Insurers’ underwriting styles and strategies can change rapidly due to the interconnectedness of global markets. Underwriters can now react instantly to current developments and trends meaning that brokers have to be just as aware in order to be able to adapt their broking strategies. We offer a view of how the underwriters want to work and what information will be key to them to be able to write your risk.

Broker tools

Access accurate and detailed risk-appetite information through our bespoke search function which shows you details of Insurer, individual underwriter, broker and individual Lloyd’s broker profiles.

Interconnect through simple enquiry forms to ensure quick and concise communication with the relevant market professionals.

Be updated in real-time of any changes to your networks risk-appetite and profiles through our notification centre.

Update your own broker profile, searchable across Insurercore, defining your risk appetite, expertise and experience.